Suven Pharmaceutical ltd

Q4&FY21 Business Updates

Company Overview -

• Suven is an integrated Contract Development and Manufacturing Operations company

• Integrated CDMO company with strong capabilities right from process research & development to late stage clinical and commercial manufacturing.

• Suven provides services to leading Global Life Science and Fine Chemical majors including Custom Synthesis, Process R&D, Scale Up and Contract Manufacturing of intermediates, APIs and formulations.

Financial Results -

Key Q4 Financial Highlights -

• Revenue - 2624 million ( 38%) ( y-o-y )

• EBITDA - 969 million ( 18%) ( y-o-y )

• EBITDA Margin - 37%

• PAT - 831 million ( 12%) ( y-o-y )

• PAT Margin - 31.37 %

Key FY21 Financial Highlights -

• Revenue - 10,239 million ( 20%) ( y-o-y )

• EBITDA - 4547 million (13.75%) ( y-o-y )

• EBITDA Margin - 44.4%

• PAT - 3623 million ( 14.3%) ( y-o-y )

• PAT Margin - 35.4%

• EBIT to Income - 41.32%

• EBITDA to Income - 44.41%

• PAT to Income - 35.38%

Key FY21 Businesswise Updates -

• CDMO Pharma - 33.11% ( y-o-y )

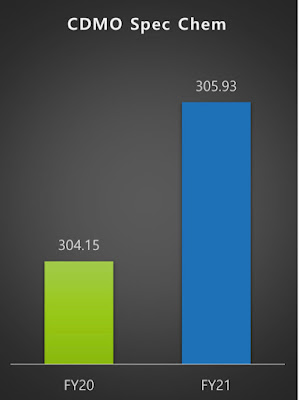

• CDMO Spec. chemicals -

• Formulations & Other Services - 7.38% ( y-o-y )

————————————————————————

Thank you for reading

Comments

Post a Comment