KEY BUSINESS UPDATES -

CONSOLIDATED PERFORMANCE -

KEY POINTS -

* Break up of Muthoot Finance Assets in Muthoot group - 90%

* Break up of Subsidiaries in Muthoot group - 10%

-----------------------------------

* Break up of Muthoot Finance Assets in Muthoot group - 99%

* Break up of Subsidiaries in Muthoot group - 1%

--------------------------------

* Interest Income grow by 15% (y-o-y)

DISBURSEMENTS and COLLECTIONS - ( In billion rupees )

* In Q1FY22, the disbursements and collections are less due to the lockdown.

KEY POINTS -

KEY POINTS -

* Total Income grow by 14% (y-o-y)

* PBT is grown by 14% (y-o-y)

* PAT is grown by 14% (y-o-y)

------------------------------

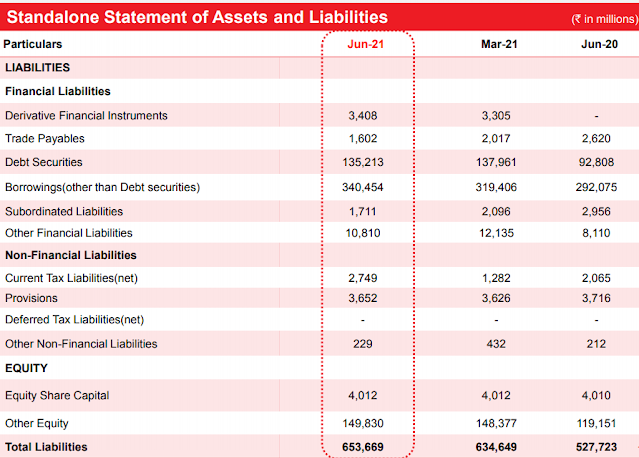

* Total Assets grow by 17.3%

* Borrowing is grown by 13.2%

* Borrowing from debt securities is grown by 47%

-------------------------

* Total Income is grown by 14%

* Total Expenses is grown by 12%

* PBT is grown by 16%

* PAT is grown by 16%

----------------------------

KEY POINTS -

* Total Gold loan book is grown by 29%

* Total Gold Segment Assets is grown by 24%

* Borrowings is grown by 16.4%

* Borrowing from debt securities is grown by 45%

-------------------------

KEY POINTS -

----------------------------

KEY POINTS OF THE GOLD LOAN PORTFOLIO -

KEY POINTS -

* Gold price/gm is 4283 rupees (June 2021) vs 4448 (June 2020)

* Margin of safety on loans is lower in Q1FY22 than Q1FY21, due to gold prices are crashes from 58,000 level to 50,000 level.———————————

KEY POINTS -

* Bad debt written off is higher in Q1FY22 than Q1FY21, due to COVID 2.0. But it is a negligible part of our loan book.

—————————-

Other Information -

* No' of Active Customers - 52,44,143 (june 2021) vs 47,45,491 (june 2020)

* Net Intrest Yield - 12.93 (june 2021) vs 13.94 (june 2020)

* Return On Average Loan Assets - 7.38 (june 2021) vs 8.1 (june 2020)

* PAT/NET INCOME - 56.05 (june 2021) vs 55.54 (june 2020)

* Provisions and write offs to

avg. loan assets - 0.26 (june 2021) vs 0.14 (june 2020)

* Return on Average Equity - 25.37 (june 2021) vs 28.16 (june 2021)

------------------------

ASIA ASSETS FINANCE PLC STANDALONE PERFORMANCE -

* Total gross loan AUM is grown by 6%

* Total revenue is declined by 2.7%

* PAT is now 10 lakh rupees vs 17 lakh loss in Q1FY21

* Total Assets are grown by 9.5%

--------------------

* Total gross loan AUM is declined by 13.7%

* Total revenue is declined by 21.7%

* PAT is grown by 25%

* Total Assets is declined by 20%

* Total number of policies is grown by 150%

* Total premium collection is grown by 36.7%

* Total revenue is grown by 7.8%

* PAT is grown by 2.3%

-----------------------

* Total gross loan AUM is grown by 19.5% (y-o-y)

BELSTAR MICROFINANCE -

KEY POINTS -

* Total revenue is grown by 40% (y-o-y)

* PAT is declined by 86% (y-o-y)

* Total Assets is grown by 9.4% (y-o-y)

---------------------

* Total gross loan AUM is a decline by 33% (y-o-y)

MUTHOOT MONEY -

KEY POINTS -

* Total revenue is declined by 46.5% (y-o-y)

* PAT is now only 1 million rupees vs 25 million rupees

* Total Assets is declined by 36.4% (y-o-y)

--------------------

KEY HIGHLIGHTS OF Q1FY22 EARNING CALL -

Q1- How much do you auction the gold?

Ans- 37 crore

Q2- What is your view on excessive liquidity?

Ans- Yes, we have excessive liquidity because of the safety and in order to benefit in the future if the opportunity will be there.

Q3- What is your plan to compete with your competitors in the gold loan segment?

Ans- See we don't say that ' Not to enter in the market ' to our competitors. We only do our business properly, but we also have some moats in the gold segments which our competitors don't have such as -

1. We are giving gold loans for up to 12 months, which our competitors neither give. Because 12 months loan is a little riskier than a 3-6 month loan. But we give all types of loans.

2. Even sometimes our customers do not repay their loan in 12 months, so we give extra time for repayment because we believe that the customer's gold is priceless for his/her. So that's why we negotiable action the gold. Even with this extra time, this loan plays as an NPA but we are ready to take this on our balance sheet for the benefit of our customers.

3. And one more thing is that we always have more liquidity than it requires because we believe that every customer who enters our shop can get a loan. So we always keep more liquidity to provide loans for every customer even this more liquidity plays as leverage for our balance sheet. But we ready to take for customers.

Q4- What is the growth prediction for the future?

Ans- 15 or more than 15.

——————————

Share Holdings Pattern -

---------------------------

THANK YOU FOR READING

Comments

Post a Comment