Alkem laboratories ltd

Q4&FY21 Business Updates

Overview - Alkem laboratories is established in 1973.Alkem Laboratories Limited is an Indian multinational pharmaceutical company headquartered in Mumbai, Maharashtra, India that manufactures and sells pharmaceutical generics, formulations and nutraceuticals in India and globally.

Q4-FY21 Financial Highlights -

* Revenue from Operations -

* EBITDA And EBITDA Margins -

* Profit After Tax -

FY21:Key Financial Highlights

Indian Business -

• India sales contributed 68.1% to total sales in Q4FY21

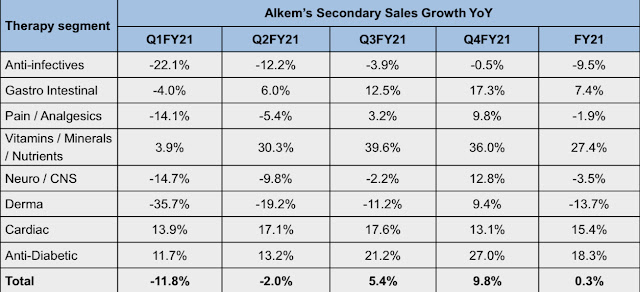

• Company witnessed good recovery in the second half of the financial year compared to YoY decline in the first half

• Company’s Trade Generic business delivered a robust growth during the quarter and the financial year

• In Q4FY21, the Company’s secondary sales grew by 9.8% YoY compared to IPM growth of 8.5% YoY (Source: IQVIA data)

• During the quarter, the Company grew ahead of the market in the therapy areas of anti-infectives, pain management, vitamins / minerals / nutrients, neuro / CNS, cardiac and anti-diabetes (Source: IQVIA

* Revenue from India Business -

* Revenue From Segments -

* Revenue from Other International Business -

Latest Shareholding Pattern (as per March 2021)

Some Extra Information -

• R&D expenses in FY21 was at 6.0% of revenue from operations compared to 5.7% in FY20

• The Company filed 9 ANDAs with the US FDA and received 25 approvals (including 6 tentative approval) in FY21

• Healthy Balance Sheet with net cash of ₹ 5.3bn as on March 31, 2021

Comments

Post a Comment